US Markets

27 May 2015 ● 07:10 AM

Recently I have stopped writing about various markets and have kept my focus only on the US. The reason is simple, most markets started to diverge and were not correlating. The US indices were making very little progress and Asian ones especially China, HK, Japan, were going through the roof. Some others were moving up in the momentum. And India was falling on its own woes. Even the Green stocks market is not giving any clear signals. So US is the only one to now watch out for from a liquidity perspective.

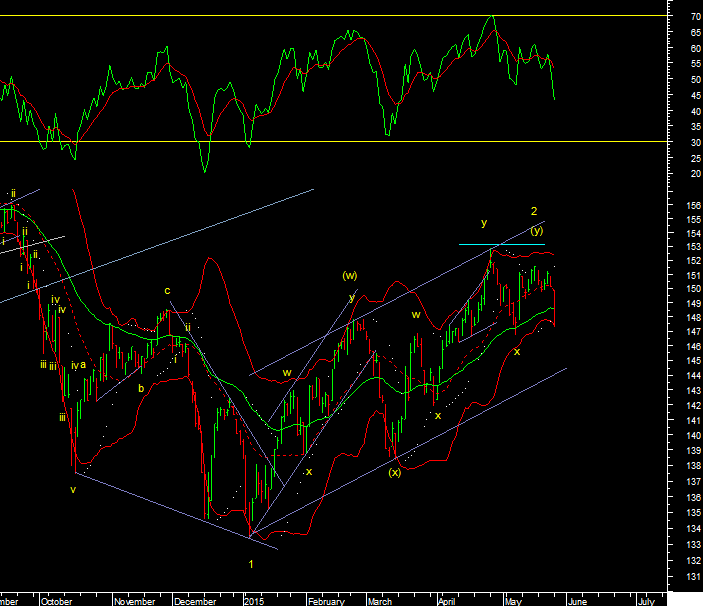

That said the NYSE composite and its long forming ending pattern appers to have completed. 2 days ago I posted a picture showing that the tops at A-C-E were exactly 60 days apart. A perfect symmetry. And wave E of the wedge is itself a triangle. All this was a perfect set up for a trend reversal. A move below the lower line at 10990 would be a break down from a ending pattern marking a significant top.

The other chart that I have not looked at since April is the ADR index which almost represents the World index [like the MSCI world]. This index has not gone above the 66% mark and the April high. Wave z up might have truncated and the last few days should have finally started wave C/3 down. A confirmation would be on break of the lower channel line.

And in all of this the lead signal has come from the Dow transports. This index did not confirm the new high in April made by other US indices and has decidedly turned down. This Dow theory non confirmation was a warning of a trend reversal which is now confirmed in the Transports, and once confirmed by other indices should mark an important top for the US markets for several months.

Comments (0)

Sort by

Latest First

Oldest First